Tonik launches in the Philippines, the country’s first neobank

With deposit interest rates of up to 6% p.a., Tonik offers deposit, payment, and card products through its app in the Philipppines.

With everything shifting online given current events, having a way to pay for bills and purchases online is all the more important. While there are already numerous online payment options, not all of them provide the same services as an actual bank, including having interest rates for savings, and others.

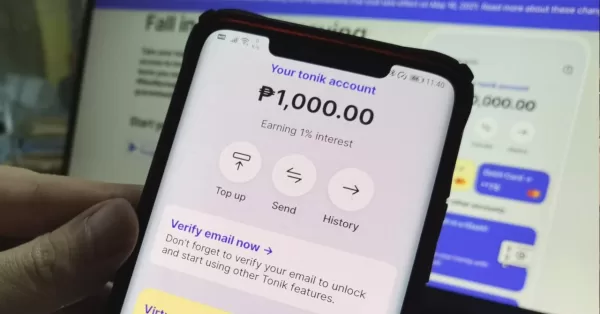

Now though, Filipinos have a new way to handle their finances as Tonik, Southeast Asia’s first digital-only bank, launches as the first neobank in the Philippines. Tonik is an online bank that introduces a completely branchless way of banking on a highly secure mobile platform, bringing bank services to more Filipinos. And yes, Tonik is supervised by the Bangko Sentral ng Pilipinas (BSP).

Powered by Mastercard, Finastra, and Amazon Web Services, Tonik has a wide array of services, though the highlight is its with industry-leading deposit interest rates of up to 6% per annum. To make saving more relevant and social, Tonik also offers unique Stash and Group Stash features, as well as traditional Term Deposits.

“Sadly, traditional banks have completely forgotten how to listen to their customer. So, we are on a quest to become the first bank brand in the Philippines with a sense of humor and an actual personality that consumers can relate to. Our mission is to trigger a wave of #NeoBankingRomance in the Philippines. We expect our proposition for the #NeoNormal to resonate particularly strongly with the ‘digital natives’ in the Philippines, who constitute most of the population,” says Long Pineda, President of Tonik Digital Bank, Inc, Tonik’s regulated bank subsidiary in the Philippines.

Tonik customers can open a fully-functional banking account in under 5 minutes, using only the Tonik App, an ID and a selfie. To top up a Tonik account, users can use interbank services, debit card, or cash-in at close to 10,000 retail agents across the country.

Aside from a savings account, users are also issued a virtual Mastercard debit card that can be used at various online merchants. Tonik will also soon offer a physical debit card, as well as the option to take out an all-digital consumer loan.

For more info on Tonik, visit http://tonikbank.com.