Install, Insure, Invest: Achieve your Goals with new services from GCash

Your GCash just became more powerful with new services like creating a digital savings account with a 2.6%/ annum interest rate.

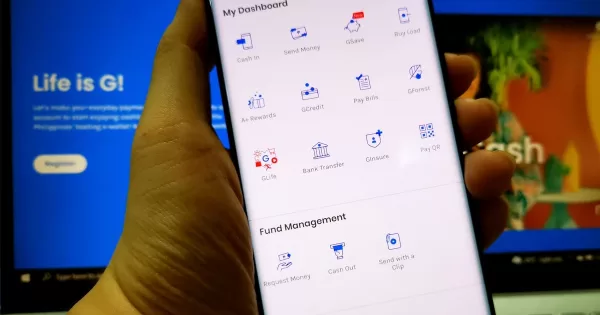

Gcash recently announced a bunch of new updates to the ever-popular online finance app that has been making cashless payments convenient ever since 2004. The new services being offered will definitely help young professionals, micro, small and medium enterprises (mSMEs) to unlock their financial goals whether its taking better care of their monthly budget, paying bills without having to go to physical counters and investing their hard-earned money for future needs.

New on the lineup will be GSave — a 24/7 easy-access digital savings account that has an annual savings rate of up to 2.6%. That’s significantly higher than most traditional banks out there.

Then there’s a more robust GInsure where one can get easy-to-understand, no-frills insurance for a varied number of instances. Whether you’re looking for a comprehensive, low-premium Dengue with Covid-19 Insurance (for about Php 700 a year with up to 350k-400k coverage), or even one for your pet, GInsure has it. Other Insurance that they carry are car insurance, personal accident insurance, medical service, income loss, your phone, and even your pet. Yup, Pet Insurance. The best part is that it’s so easy to apply and, of course, pay for your premiums via GCash.

GCash also enables individuals and mSMEs access to credit. With both GGives and GLoan, both allowing flexible payment plans of either credit or straight-up cash loans from GCash.

GGives is an easy pay-later option that allows users to purchase gadgets, appliances, furniture and even plane tickets, among others worth up to P50,000 from 85,000 partner stores nationwide and pay for them later up to 24 gives over 12 months; and GLoan, which offers easy and fast cash loans up to P50,000 repayable up to 12 months with low interest rates and are suitable for digital entrepreneurs with growing online businesses.

Financial Literate Filipinos — that’s the Goal

Aside from introducing various digital financial solutions, GCash is also maximizing the use of social media in its drive to educate and engage the youth on the benefits of using the app and learning more about its financial services.

Users can find GCash’s educational content on YouTube, Facebook, TikTok, Twitter, Instagram where they can learn from financial and medical experts, inspirational celebrities and other social media influencers. These include tutorials, life-goal hacks, and personal stories. They also answer frequently asked questions on finances and discuss the advantages and disadvantages of certain financial products, offer tips to develop the right mindset and behaviors toward money to avoid financial mistakes.

GSave’s Ipon Challenge also engages GCash users to post their Savings Tracker on Twitter to help show the ease and importance of saving for their future. Recently, GCash launched “Payaman Series”, video episodes of inspiring personal stories on how GCash ambassadors struggled financially and eventually got back on track with the help of GCash.

To know more about GCash and its financial services, visit https://www.gcash.com.